How Can Artificial Intelligence help Investment Banking Risk Management?

Beyond Just Calculations….

The risk management algorithm has always been more about complex calculations. There are various models such as the binomial model, VaR (Value at Risk), Black-Sholes Morten model. These models are put into different simulation modeling algorithms such as Monte Carlo simulation, GARCH (1, 1) also known as Generalized autoregressive conditional heteroskedasticity model, EWMA, which are currently used by the banks. CME (Chicago Mercantile Exchange) developed risk management algorithms PC-SPAN for portfolio margining

- SPAN has been reviewed and approved by market regulators and participants worldwide.

- SPAN is the official Performance Bond mechanism of over 50 exchanges and clearing organizations worldwide, making it the global standard for portfolio margining

Risk management is the application of the risk management process which consists in:

The future challenge to integrate Risk management in every area of a company means “operational,” “economical”, and “strategically, Enterprise Risk Management (ERM) will be a need for the future management processes.

The latest developments that are shaping up in the Fintech focused on the Risk Management is an application of Artificial Intelligence in the Financial Risk Management.

How different methodology of a quantitative risk analysis to develop a formal risk management can leverage Artificial Neural Networks

What is similar between an engineer controlling an industrial facility and a bank operations manager controlling payment processing? Both deal with operational risks that require immediate action at the earliest sign of trouble. Process for both is same as described in below diagram

Financial Institutions are primarily risk managers and manage a variety of financial risks — market, credit, operational, currency, liquidity, and others. For having a robust risk management the bank need to ensure that it should embrace data-informed technologies that are being applied to the following

Why need the Black Box?

Data-Informed Operations

Data-informed operations are the basis for day to day operations. No matter how sophisticated the data collection and processing systems are, a trained human is ultimately responsible for making critical decisions. The bank operations managers can perform exception processing and error recovery based upon system-generated communications.

Any analytics applications that are guiding their decisions will submit their findings to a human, to effect any changes to operations. The reason why operations department run by large sized teams who are challenged to keep improving their effectiveness through improved process and use of the latest cutting-edge technology.

Chasing False Alarms

Risk management teams use expert systems, primarily based on rules, to monitor operations and generate alerts. Expert risk managers set alerts based on rules, historical thresholds, specific KPIs, and the tuning of each of these over time takes up a lot of the time of experts to maintain the balance between risk exposure and team efficiency, and that has its consequences.

One of the biggest challenges of improving effectiveness is false alarms raised by analytics technologies currently used. Not being sensitive enough means that the risk exposure is higher, being too sensitive also means the operations team under much pressure is chasing false alarms.

No algorithm is useful in isolation, but instead from the perspective of how it interacts with its environment (data sampling, filtering, and reduction) and also how it manipulates or alters its environment. Therefore, the algorithm depends on an understanding of the environment and also a way to manage the environment

Any rules-based systems pose a major dilemma to an operations person because; the cost of missing an actual exception, models may be tuned extremely conservatively. As a result of this, it significantly increases operational cost, but they also create “alarm fatigue”, in which operators expect false alarms to such an extent that they miss a genuinely positive and allow an improper transaction.

Harry Henderson proposed an AI model which has both the old rules memory and a working memory where the model intelligently learns from the current environment and the rule matching system quickly re-tweaks the rules so as to avoid false alarms without losing the original exceptions

Trends and Human Processing (What is in the BLACK BOX?)

A robust risk management is about dealing with real-time transactional data and historical trends/learnings; there is an important aspect of time that affects how decisions are made. In general, humans are good at interpreting simple trends by looking at slopes and levels, but human have limitations to describe complex patterns. A solution to the problem is if expert AI systems can encode these trends

The problem with the AI system is when different pieces of information don’t arrive at the same time or rate, incorporating the trends in such data into any AI system tends to be difficult.

For example – In the case of the Monte-Carlo simulation the inputs may be fixed, but the frequency of the inputs A, B, C, and D may vary leading to which the random number generation of the Monte-Carlo model(MCM). May not follow the probability distribution curve which is a function of (PDF), to ensure that various risk has been factored the outputs of the MCM would be evaluated and tested for the hypothesis using multiple regressive inputs to validate the confidence level of the model.

A critical aspect for the Risk Modeler is to select the appropriate distribution function according to the data available; it can follow any Log function, Normal distribution, Chi –squared distribution function, etc. The modeler also needs to understand the behavior of the data in the practice; typically it is based on an available historical database.

Monte Carlo Simulation Model for risk assessment

This problem is exacerbated in financial services applications where trends are formed (and change) over periods of days, weeks or even years. Operations users cannot be expected to recognize long-term trends in customer behavior without expert system assistance. The result of such difficulties is it increases the number of effort people has to put into confirming alarms by interpreting patterns.

Expert instead of Learning Systems (Mind in the Box)

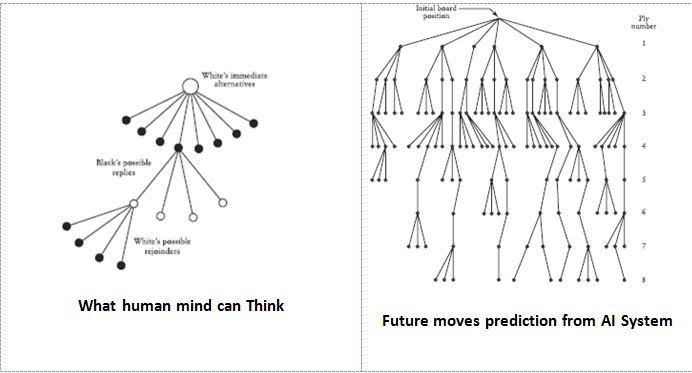

The next issue is that expert systems do not change by themselves as they have to be programmed by experts. The main advantage of AI system is that the whole process (training and testing) mimics the human brain reasoning like learning occurs in the minds of experts who then apply the lessons of their learning into the next versions of the rule engine base.

With the rapidly changing financial business and data landscape, the operational systems have not evolved quickly enough. This leads to more risk exposure and less optimized use of the margin money.

For example – Game of Chess

But then the questions comes Can machine ever have a mechanism to reach a conclusion based on just common sense which is beyond logical reasoning? Can machines present facts which are beyond the mathematical formulas? Can machines make a logical deduction of the cases which has the rarest or the rare possibility of occurrence to ensure optimal use of time and resource?

Would AI system get thumbs up or thumbs down in future, is something that only time will tell, as the commercial application of AI has to withstand the challenge of diversity as different Banks, Insurance companies, funds and financial firms don’t speak the same risk – language. Never the less each one of them performs the cost-benefit analysis, sensitivity analysis, scenario analysis which permits to perform both the quantitative and qualitative analysis

Happy Reading!!